Deadline to enroll in Affordable Care coverage

Published 7:01 am Thursday, January 23, 2014

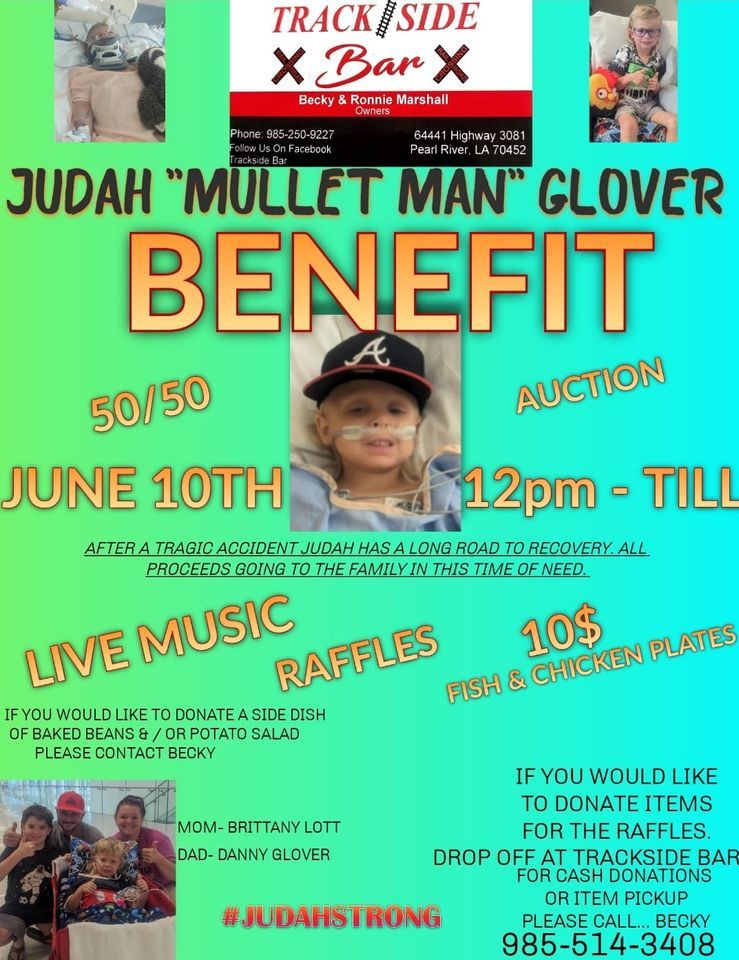

Pat Riley, Director of Insurance Operations for Forrest General, explains about financial assistance available to cover cost of the health care plans

Photo by Alexandra Hedrick

The deadline to enroll in a health insurance plan through the health care marketplace is fast approaching; March 31 is the last day for individuals who qualify for coverage under the Affordable Care Act.

Highland Hospital held an information session on Tuesday morning to inform people of the changes and how to enroll in a health care plan if they are eligible.

Pat Riley, Director of Insurance Operations for Forrest General, who spoke at the session said individuals who don’t have an employer health plan or are covered by Medicaid, aren’t eligible to participate in the health care marketplace.

Riley said the Affordable Care Act was designed for individuals who don’t have or qualify for any type of health plan.

Two health insurance companies, Humana and Magnolia, are the only companies over insurance through the marketplace.

Individuals in Pearl River County will only be able to choose plans provided by Humana, Riley said.

“I do think in the coming years, I think there will be more options,” Riley said.

Some key changes to health insurance that have been in effect since 2010, include allowing children to stay on their parents’ plans until they’re 26 years old, guaranteed coverage for all children under 19 years old, including those with pre-existing conditions; 100 percent coverage for preventative screenings; and unlimited lifetime benefits, Riley said.

He pointed out that starting in 2014, there will be penalties for individuals and families with no health insurance, unless their income exempts them from the penalties.

“People who are right at the federal poverty level will not have to worry about paying a penalty,” Riley said.

The penalties for 2014 are $95 per adult, $47.50 per child with a family maximum of $285 or one percent of the household income, whichever is greater, Riley said.

In 2015, penalties per adult will increase to $325 and $162.50 per child with a family maximum of $975 or two percent of the household income.

Each year the penalties will continue to increase, Riley said.

There are five levels of health care plans available through the marketplace.

The more benefits that are provided in the plan, the higher premium costs will be, Riley explained.

The levels are catastrophic, bronze, silver, gold and platinum. Riley explained platinum has the highest premium with the lowest out of pocket costs.

Individuals and families that fall between 100 percent and 400 percent of the Federal Poverty Level qualify for some type of financial assistance.

Riley said two types of financial assistance are available” advance tax credits and cost-sharing subsidies.

Advance tax credits pays part of the monthly premiums and cost-sharing subsidies pays for some medical services.

Riley said to qualify for the cost-sharing subsidy, the applicant must enroll in the silver plan and be between 100 percent and 250 percent of the Federal Poverty Level.

“In Mississippi, if your Federal Income Level is less than percent, you don’t qualify for federal assistance,” Riley said.

He explained that because the state government decided not to expand the Medicaid program, there is a portion of the population that won’t have health insurance.

Many in the audience were upset and said they needed to get involved politically to expand the Medicaid program.

The Affordable Care Act was enacted on March 23, 2010 and required changes to health care to protect consumers and expand access to health insurance coverage.